As a valued client I thought you may like to receive a summary of our market assessment on what’s currently impacting insurance pricing in the Australian market.

General insurance premium pricing September 2020 – outlook for 2020/21

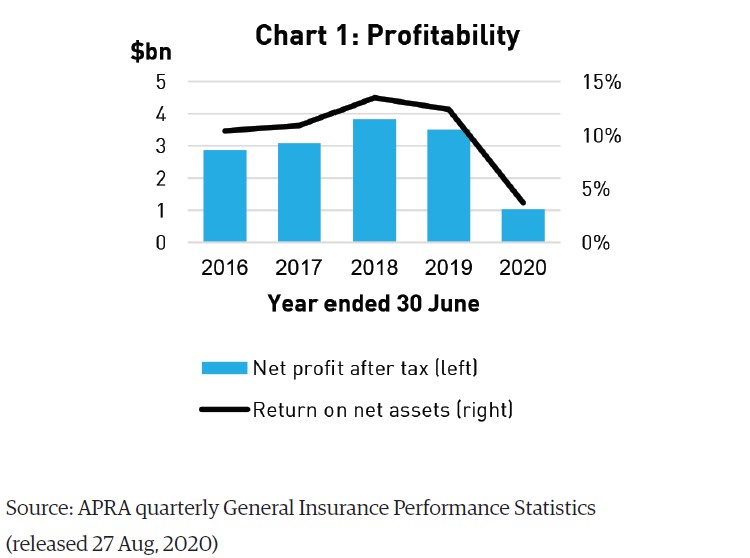

The recently released APRA (Australian Prudential Regulation Authority) June 2020 quarterly report showed insurance company profitability continuing to decrease, the chart below is at 30 June 2020.

The chart highlights declining industry profitability for the 12 month period to 30 June 2020. This was due to the catastrophic bushfire and storm events of late December/early 2020, and large falls in investment returns mainly attributable to the impact of COVID-19 on investment markets and continuing cycle of low interest rates.

All underwriters are now experiencing shocks to every side of their financial statements, through deteriorating loss ratios on both short (motor, home, commercial property) and long-tail classes (public liability). The declining investment market has also had a significant impact on insurance industry profitability.

After a year of average market increases of around 6% – 8% for commercial insurance and 12%+ for large property assets, the recently released APRA statistics indicate premiums will continue to rise in the vicinity of 9% – 12% for the next twelve months.

Of course, there are other market forces also at play, some of which are outlined below.

A sustained period of low interest rates has had a significant impact on Insurers’ results.

Whilst interest rates and investment returns are falling claims reserves need to be ‘topped up’.

The AU$ is now hovering around US73cents (September 2020). This has seen the continuation of claims cost inflation being higher than the general rate of inflation across the Australian economy. The impact has been particularly noticeable in repair costs of motor vehicles that rely on imported replacement parts and any building materials or equipment imported as part of a claims settlement.

In the past decade or so the amount of losses held locally by insurance companies has increased. This means many smaller weather events, for example, aren’t falling into reinsurance treaties – and local companies are picking up the losses to their net account.

Looking to the future

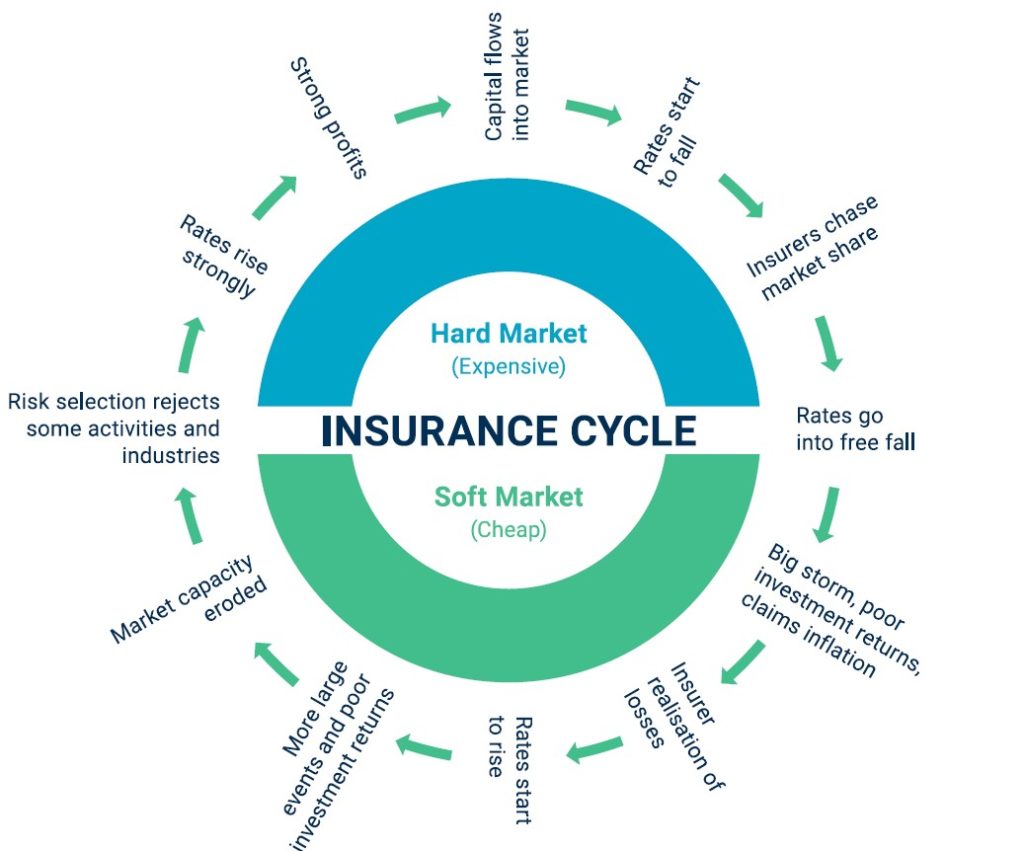

The insurance industry, we believe, is hovering around 9 to 10 o’clock on the ‘insurance clock’ (pictured below). This will see average increased pricing of 9% – 12%. The amount of increase will be influenced by your industry sector, geographic location, prior claims experience and your approach to risk management.

Structural change and cost cycles are part of every industry, and insurance is no different. The insurance clock is a useful tool to represent where Insurance rates are right now and where they’re likely to be heading in the future.

With this hard market cycle, we will see:

- Period of higher premiums

- Getting insurance coverage could become more difficult and harder to negotiate terms

- Insurers reducing capacity to take on some risks or industry groups (e.g. recycling, financial services, directors/officers insurance)

- Higher excesses being requested

- More time required by your adviser to place your insurance, often this will mean additional information is required from you.

In this environment, it’s crucial we continue to work together to maintain policy terms and conditions even though prices are on the increase. After all, as our experience shows us time and time again, price is ultimately forgotten when an insurable loss happens.

Click to download article as PDF

Questions?

If you have questions or want to discuss your specific situation, or get free review and quote for your insurance solution, please contact us.