General insurance market premium pricing – May 2022 – outlook for 2022/23

As your dedicated general insurance Adviser, we’re constantly monitoring the insurance market to better understand and assess the trends with potential to affect your business. With this in mind, we wanted to share a summary of our updated market assessment on the factors currently impacting insurance pricing in Australia.

As your dedicated general insurance Adviser, we’re constantly monitoring the insurance market to better understand and assess the trends with potential to affect your business. With this in mind, we wanted to share a summary of our updated market assessment on the factors currently impacting insurance pricing in Australia.

The recently released APRA (Australian Prudential Regulation Authority) quarterly report shows improved profitability for the 12 months to December 2021. Industry profitability had improved, but the recent La Nina weather cycle has seen severe flooding/storm activity on the east coast of Australia and bushfire activity in Western Australia. As of March, the Queensland and New South Wales floods have seen over 168,000 claims lodged with an estimate of insurable losses reaching $2.3 Billion.

Pricing and capacity

The impact of flattening investment returns and rising costs of claims remains significant. We will continue to see capacity and variety of insurance products reduced, meaning premium rates will most likely continue to trend upwards with reduced cover available.

After a year of average increases (8-10% for Commercial and 15%+ for large Property assets, as well as 20% for Professional Indemnity policies), APRA statistics indicate premiums will continue to rise in the vicinity of 8% – 12% for property and 10% – 15% for Professional Indemnity policies over the next 12 months. Risks with claims or in high-risk industries will be subject to higher premium and excess increases and will continue to have difficulty in finding capacity.

Other market forces

Below are some of the other key factors impacting the insurance market.

Low interest rates

Historically low interest rates continue to place pressure on Insurers’ returns. Whilst interest rates and investment returns remain flat, claims reserves need to be ‘topped up’. There are now early signs of interest rates increasing over the next period of time which will improve investment returns for insurers.

AU$

The AU$ is currently US69cents (May 2022) This has seen the continuation of claims cost inflation remaining higher than the general rate of inflation across the Australian economy. The impact will be higher costs for materials or equipment imported as part of a claims settlement.

Supply Chain Issues

The global Pandemic has also impacted supply chains, this is now culminating in significant delays in the supply of materials, white goods and vehicles. Therefore claims settlements and rebuilding is taking longer. Labour shortages have also impacted the availability of trades people to rectify insurable property losses.

Looking to the future

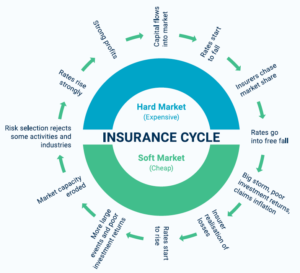

The Insurance Industry, we believe, is at 10 o’clock on the Insurance Clock. How long it remains there largely depends on the frequency and severity of future catastrophic events and general profitability. With catastrophes becoming more frequent and more costly, we believe average premium increases will remain in the range of 8%-12% over the next 12 months. The exact increases will be influenced by industry sector, geographic location, prior claims experience and approach to risk management.

Structural change and cost cycles are part of every industry. The insurance clock is a useful tool to represent where insurance rates are right now and where they’re likely to be heading in the future.

With this hard market cycle, we anticipate:

✓ Continued period of higher premiums

✓ Reduced cover being offered

✓ Insurers reducing capacity for individual risks (directors & officers and professional indemnity and industry groups – e.g. recycling, financial planning)

✓ Higher excesses or increased risk retention

✓ Increased focus on risk management

✓ More time and additional information required to place insurance.

It’s crucial we continue to work together to find competitive premiums and maintain policy terms and conditions, especially with premiums on the increase.

Property sums insured

The Insurance Council of Australia (ICA) estimates some 83% of properties lack the right cover or have the wrong sums insured. Rebuilding costs have been increasing due to COVID related issues, plus supply chain disruptions. In addition, almost 100,000 buildings have been damaged in the recent storms, creating further pressure on labour and material costs.

We therefore recommend that you review your coverage regularly, as well as the cost of rebuilding to ensure you’re adequately insured. Having less than the replacement value insured at the time of loss may result in delays in claim settlements and being paid less than you expect. Having a professional valuation will assist to prevent this. As your Adviser, I can arrange access to professional quantity surveyors that can professionally calculate rebuilding costs for homes, commercial buildings and replacement values of plant and equipment.

These reviews cost a flat rate of $600 + GST at all locations in Australia.

Cyber insurance

It has been reported that the number of cyber claims have increased by over 50% in the 6 months to 31 December 2021. Most cyber claims are related to human error as a result of employees clicking on links in emails not checking the legitimacy of payment requests, etc. If you or your team would like access to our free online cyber awareness training please follow the registration details on the next page. We can also offer cyber insurance to assist you in mitigating the financial loss, as well as experts to get your business back up and running as soon as possible, after a cybercrime attack.

IA cyber awareness training

How to register

Go to www.iacyberaware.com to register.

Go to www.iacyberaware.com to register.

Once on the registration page enter the code 31100 before hitting Accept & Register.

Fill in the registration details including an email address and secure password for future use. Also select the Insurance Advisernet Authorised Representative who is your company’s insurance adviser (Acacia Insurance) before hitting ‘Save & Exit’.

Once registered you will be able to login and access the training program at any time with your dedicated email and password.

For further support please contact the Help Desk at any time at support@iacyberaware.com.

Should you have any questions, or would like to arrange a valuation or more information on Cyber Insurance, please don’t hesitate to get in touch. We’ll be more than happy to assist.

Should you have any questions, or want to book a review, please don’t hesitate to get in touch. We’ll be very happy to help.

![]()

Download PDF version of this update here.