General insurance market update

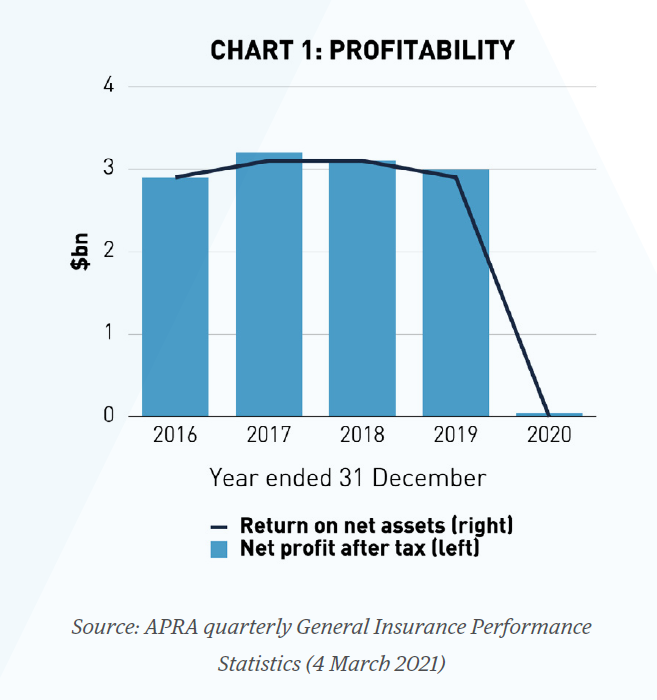

As your dedicated insurance representative, we’re constantly monitoring the insurance market to better understand and assess the trends with potential to affect your business. With this in mind, we wanted to share a summary of our updated market assessment on the factors currently impacting insurance pricing in Australia. The recently released APRA (Australian Prudential Regulation Authority) quarterly report shows a significant decline in industry profitability for the 12 months to December 31, 2020.

This decline can be attributed to three primary factors:

- Major 2019/2020 bushfire and storm events

- Provisions for potential COVID-19 related Business Interruption claims (dependent on current court proceedings)

- Continuation of falling investment returns, due to the uncertainty of economic rebound from COVID-19 and historically low interest rates.

Pricing & Capacity

The impact of declining investment returns remains significant. It will continue to see capacity and product supply weakened, meaning premium rates will most likely trend upwards. Whilst pricing has been the primary lever used by Insurers over the past 24 months, capacity is becoming an increasing concern, with some Insurers withdrawing from what were previously considered ‘vanilla’ risks. We anticipate cover for some industries and locations will remain unattainable until more profitable levels return.

After a year of average increases (8-10% for Commercial and 15%+ for large Property assets), the recently-released APRA statistics indicate premiums will continue to rise in the vicinity of 10-15% for the next 12 months.

Other Market Forces

Below are some of the other key factors impacting the insurance market.

- Low Interest rates: Historically low interest rates continue to place pressure on Insurers’ returns. Whilst rates and investment returns remain flat, their claims reserves need to be ‘topped up’ – especially in he face of more frequent catastrophic events.

- AU$: The AU$ remains at relatively constant levels around US77cents (May 2021). This continues to see claims cost inflation higher than the general rate of inflation across the Australian economy. Significant impacts are felt in the repair costs of motor vehicles that rely on imported replacement parts and any building materials or equipment imported as part of a claims settlement.

- Insurance Company Net Retentions: In the past decade, the level of losses held locally by Australian insurance companies has increased. Global reinsurers are seeking to distance themselves from more frequent and severe cat loss events, with local insurers left to pick up the losses to their net account.

Looking to the Future

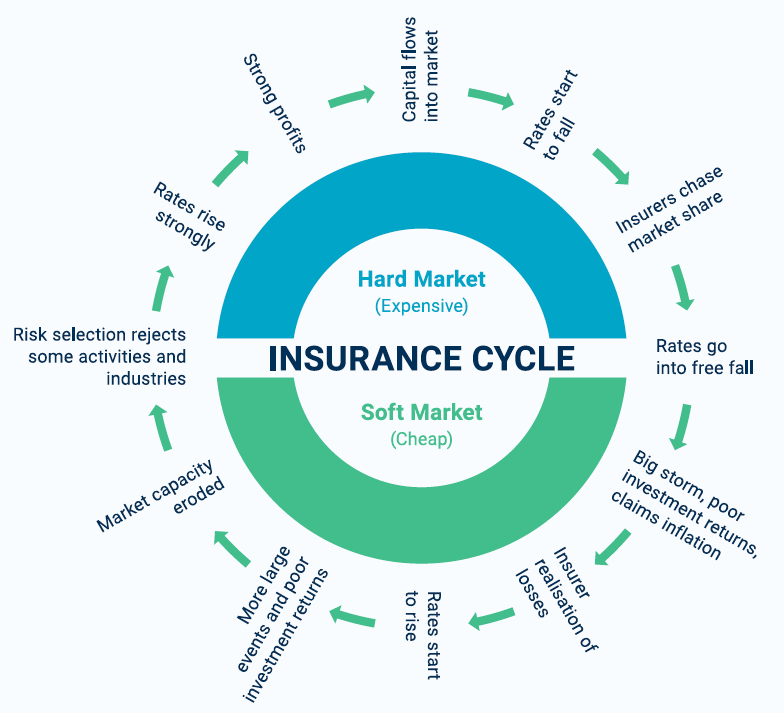

The Insurance Industry, we believe, is at 10 o’clock on the Insurance Clock. How long it remains there largely depends on the frequency and severity of future catastrophic events. It’s clear, without corrective action, the Industry cannot sustain continual year-on-year catastrophic events whilst still providing cover for ‘usual’ loss events. We subsequently believe average premium increases will remain in the range of 10-15%. The exact figures will be influenced by industry sector, geographic location, prior claims experience and approach to risk management.

Structural change and cost cycles are part of every industry. The Insurance Clock is a useful tool to represent where Insurance rates are right now and where they’re likely to be heading in the future.

With this hard market cycle, we anticipate:

✓ Period of higher premiums

✓ Getting insurance coverage could become more difficult and harder to negotiate terms

✓ Insurers reducing capacity with some risks or industry groups (e.g. recycling, financial services, directors/officers insurance)

✓ Higher excesses

✓ Focus on risk management and mitigation processes

✓ More time and additional information required to place insurance.

It’s crucial we continue to work together to maintain policy terms and conditions, even with prices on the increase. After all, as our experience consistently shows, price is ultimately forgotten when an insurable loss happens. Should you have any questions, please don’t hesitate to get in touch. We’ll be very happy to help.